If you’re planning to sell high-value real estate in New Jersey, it’s time to take note: major changes to the state’s mansion tax go into effect on July 10, 2025. These updates significantly impact who pays the tax, how much is owed, and which transactions are affected.

As a full-service law firm with deep experience in real estate, tax, and transactional law, our team at Mandelbaum Barrett PC is here to help you understand what these changes mean for your next deal.

What Is the New Jersey Mansion Tax?

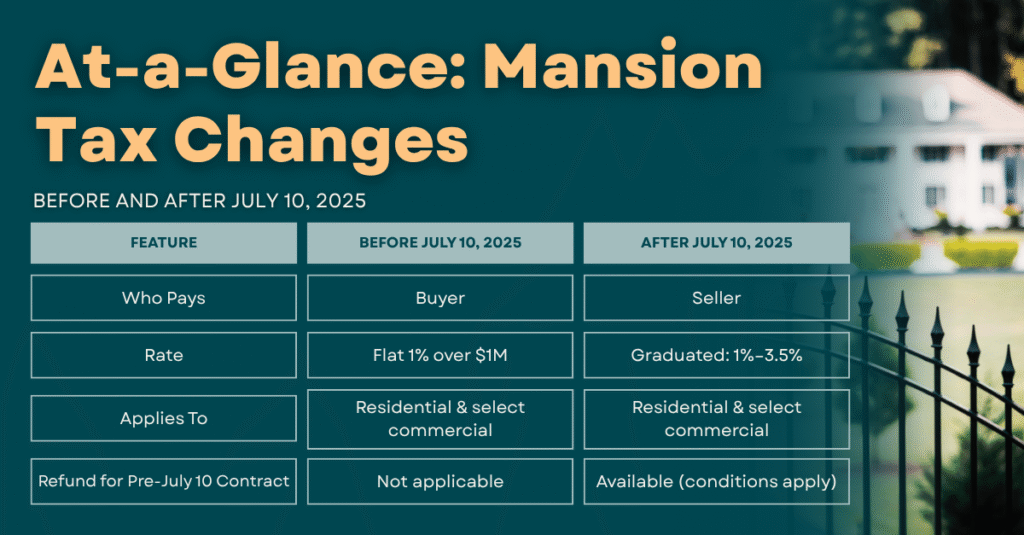

Historically, New Jersey’s mansion tax was a 1% fee paid by the buyer on residential or certain commercial property sales over $1 million. But that all changes in mid-2025, when a new graduated rate structure takes effect—and the seller becomes responsible for paying it.

Key Changes to the Mansion Tax in 2025

Here’s a quick breakdown of what’s changing:

- Responsibility Shift: The tax will now be paid by sellers, not buyers.

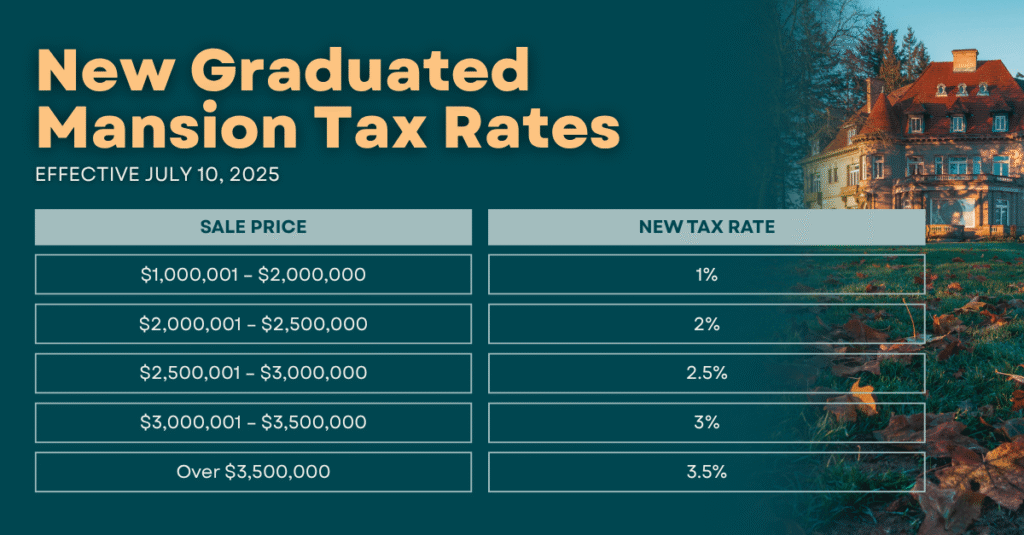

- Graduated Rates: Instead of a flat 1%, the rate now increases with the full sale price.

- Wider Applicability: Applies to residential, certain commercial properties, and transfers of controlling interest in entities holding qualifying real estate.

- Refunds for Pre-July 10 Contracts: Sellers can apply for a refund under certain conditions.

⚠️ Note: These rates apply to the entire purchase price, not just the amount above $1 million.

What Types of Property Are Affected?

The updated mansion tax applies to:

- Class 2: Residential properties

- Class 3A: Farmland with residential buildings

- Class 4A: Certain commercial real estate (excluding industrial or multifamily/apartment buildings)

- Class 4C: Cooperative units

It also applies to the transfer of controlling interest in business entities that own qualifying property.

Timing and Refund Opportunities

The new rates go into effect July 10, 2025, and apply to all closings from that date forward. However, if:

- A contract is fully executed before July 10, and

- The deed is recorded by November 15, 2025,

then the seller may apply for a refund to pay the previous (lower) rate.

🕒 Refund applications must be submitted within 12 months of deed recording.

What About the Realty Transfer Fee (RTF)?

The New Jersey Realty Transfer Fee (RTF) remains unchanged. It is still a separate fee paid by the seller on residential property transactions, calculated on a separate graduated scale. Mansion tax and RTF are two distinct obligations.

Final Thoughts: What This Means for Sellers

The new mansion tax structure is part of New Jersey’s broader effort to increase revenue from high-end real estate transactions, especially in luxury residential and commercial sectors. Sellers should work closely with legal and tax professionals to:

- Structure deals strategically

- Assess refund eligibility

- Understand total tax exposure

For more information on mansion tax, you can reach Martin D. Hauptman at mhauptman@mblawfirm.com or at 973-243-7912.